Tax residency determines where you file returns on your worldwide income. An incorrect assessment can mean double taxation, penalties, or years-long disputes with tax authorities in two countries simultaneously. We help you precisely establish tax residency, protecting you from legal and financial consequences.

When You Must Establish Your Tax Residency

A move with your entire family to Dubai, spending three hundred days a year there, or remaining in Poland with your home, work, and family – these are cases where tax residency is obvious. The problem begins when you divide your life between two countries – you work in Germany while your family lives in Poland; you formally reside in the Emirates but regularly return home; you spend half the year here and half there. In such situations, domestic law alone doesn’t suffice – international treaties decide, taking precedence over Polish regulations and containing precise rules for resolving ambiguous cases.

Your situation isn’t obvious when:

You divide your life between two countries

- You work in Germany Monday through Friday, spending weekends in Poland with family

- You live half the year in Poland, half in Dubai

- You ran a business in Poland, relocated to the United Arab Emirates, but maintain Polish companies

You relocated during the tax year

- You moved abroad in February – you don’t know if you’re a Polish resident for the entire year

- You returned to Poland in October after years working abroad

- You’re planning emigration and want to know when you’ll cease being a Polish resident

You have a temporary contract abroad

- You left for two years to Singapore to develop a firm’s Asian division

- You’re working under contract in Norway but left your family in Poland

- You have an eighteen-month project in the UAE – you don’t know if this changes your residency

You received a foreign residency certificate

- You have a certificate from Malta, but Polish authorities claim you’re still a Polish resident

- A foreign bank requires a Polish certificate, but you don’t know if you’re entitled to one

- You possess certificates from two countries simultaneously and don’t know which matters

Consequences of Incorrectly Determining Tax Residency

- Double taxation

Two countries recognize you as their resident and each wants to tax your worldwide income. You pay tax twice on the same revenues.

- Penalties and interest

Polish authorities determine you concealed foreign income. Foreign authorities determine you didn’t register as a local resident. Penalty amounts can exceed the tax itself.

- Years-long proceedings

A dispute between tax authorities of two countries can drag on for years. Without unambiguous residency establishment, you’re helpless against demands from both administrations.

- Blocked accounts and transactions

Banks and financial institutions require residency confirmation for FATCA and CRS purposes. Lack of certainty can freeze your assets.

Legal Assistance in Establishing Tax Residency

Even if Polish law recognizes you as a resident, an international treaty can definitively decide otherwise. This isn’t a technical detail – it’s the system’s foundation, inscribed in Article 4a of the Personal Income Tax Act, which grants double taxation avoidance treaties precedence over domestic tax regulations.

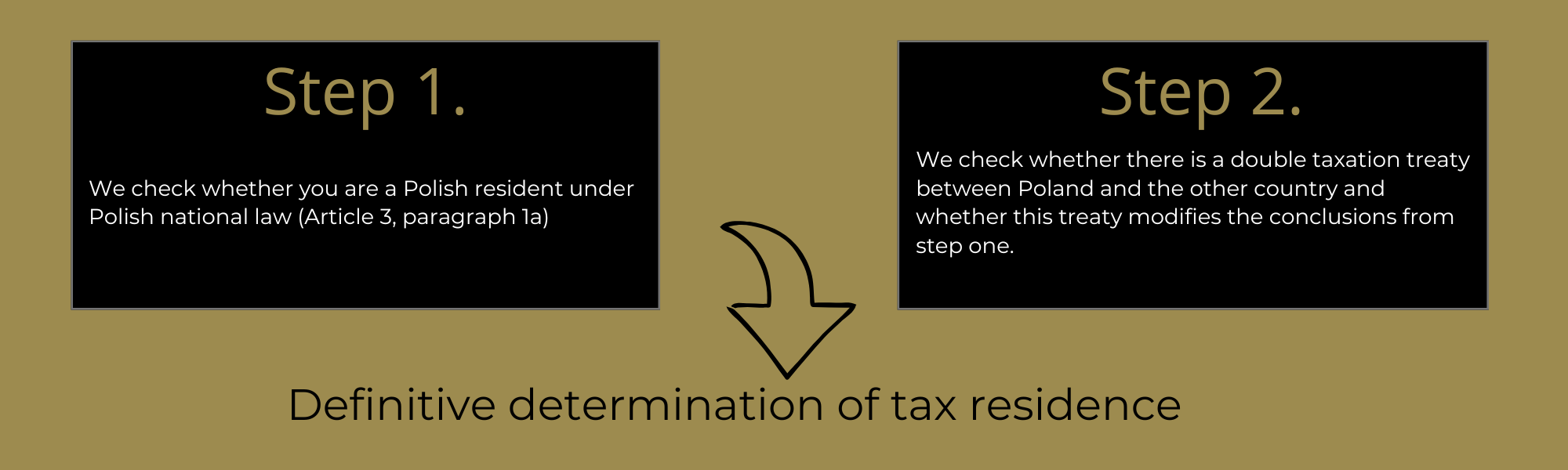

In practice, this means that residency analysis in international matters always proceeds in two stages:

Our Services

Detailed analysis of your situation

We examine all factors determining residency:

- Where you have a permanent home (ownership, rental, availability)

- Where your center of personal interests lies (family, friends, social activity)

- Where your center of economic interests lies (income sources, assets, business activity)

- How many days you actually spend in each country (the 183-day test)

- What citizenship you hold and what your future intentions are

Application of international treaty (if applicable)

Poland has concluded over ninety double taxation avoidance treaties. We analyze:

- Whether you meet residency criteria under Polish domestic law

- Whether you meet residency criteria under the other country’s law

- Which state is your resident according to the international treaty (treaties take precedence over domestic law)

- The hierarchy of decisive criteria: permanent home → center of vital interests → habitual abode → nationality

Written legal opinion

We deliver a document that:

- Unambiguously indicates your place of tax residency

- Explains the legal basis (domestic regulations + international treaty)

- Contains analysis of facts and their legal qualification

- Indicates risks and alternative scenarios (if they exist)

Application for individual tax ruling (optional)

If the situation is complex, we prepare and file an application on your behalf to the tax authority:

- The authority officially confirms your residency

- The ruling protects you legally

- No authority can challenge your position confirmed by the ruling

Tax Residency Determination Rules

Five Criteria Deciding Tax Residency

The hierarchy that ends disputes between countries.

When two countries simultaneously recognize you as their tax resident, international treaties apply a sequential hierarchy of decisive criteria – so-called tie-breaker clauses. These criteria are examined sequentially until only one state remains as the place of residency. If the first criterion unambiguously indicates a country – further criteria are no longer examined.

Criterion 1: Permanent home

You are a resident of the country where you have a permanent home.

This isn’t an address on your ID or residence registration. It means a place you’ve furnished and reserved for your permanent use – an apartment or house available to you continuously, not occasionally.

A permanent home IS:

- An apartment rented for three years where you live with family, which you’ve furnished, where you keep your belongings

- Your own house where you permanently reside

- Company housing available for an indefinite term

A permanent home IS NOT:

- A hotel room rented for a year

- An apartment where you stay only occasionally (e.g., two weeks per year)

- A place available only temporarily or at specific times

If you have a permanent home in both countries or in neither – we proceed to criterion 2.

Criterion 2: Center of vital interests

You are a resident of the country with which you have closer personal and economic ties.

This is a holistic assessment of your life – there’s no single deciding factor. The following are analyzed:

Personal ties:

- Where family lives (spouse, children)

- Where friends and social relationships are

- Where you conduct social, cultural, political activity

- Where your roots are and where you plan your future

Economic ties:

- Where main income sources are (work, business, companies)

- Where assets are (real estate, savings, investments)

- From where you manage your financial affairs

- Where you conduct business activity

Example: You work in Germany, but your wife and minor children whom you support live in Poland, you have a house here, you plan to return – the center of vital interests is in Poland, despite spending most of your time in Germany.

If the center of vital interests cannot be unambiguously established – we proceed to criterion 3.

Criterion 3: Habitual abode

You are a resident of the country where you usually, regularly stay.

This concerns actual, customary presence – where you spend most of your time during the year. This often comes down to counting days, but with emphasis on regularity, not the mechanical 183-day threshold.

Example: You spend 220 days in Norway (work) and 145 days in Poland (vacations, holidays) – habitual abode is Norway.

If you habitually stay in both countries equally or in neither – we proceed to criterion 4.

Criterion 4: Nationality

You are a resident of the country whose citizen you are.

A simple auxiliary criterion, applied only when previous ones haven’t decided. If you have Polish citizenship – you become a Polish resident.

If you’re a citizen of both countries or neither – we proceed to criterion 5.

Criterion 5: Mutual agreement procedure (MAP)

Tax authorities of both countries resolve the matter jointly.

This is a last resort when none of the above criteria work. Tax authorities of Poland and the other country negotiate and jointly establish where your residency is. Applied very rarely in practice.

In 95% of cases, residency is established at criterion 1 or 2. Our analysis determines which criterion decides your situation and why.

Legal Foundations

OECD Model Convention: The Common Language of International Tax Law

Poland has concluded over ninety double taxation avoidance treaties with various countries worldwide. And though each treaty is technically a separate international accord, in practice they’re surprisingly similar to each other. Why? Because nearly all are based on the same template: the OECD Model Tax Convention on Income and on Capital.

The OECD Model Convention is a document developed by the Organisation for Economic Co-operation and Development, comprising the world’s most developed economies. It’s not a binding source of international law – it’s a model, a template that countries can use when negotiating their bilateral treaties. But in practice, this template is so widely accepted that most tax treaties worldwide have nearly identical structure and use nearly identical formulations.

Along with the Model Convention, the OECD publishes Commentary – an extensive document explaining how particular Convention articles should be interpreted. And here something remarkable happens: though the Commentary isn’t a binding source of law, Polish administrative courts, the Supreme Administrative Court, tax authorities regularly reference it as an interpretive authority. Why? Because the Commentary represents international consensus on how to understand particular concepts and clauses. It was developed by experts from all OECD countries. It constitutes a common language that allows avoiding situations where the same formulation in a treaty is understood completely differently in Poland and in Germany.

For taxpayers, this means something very practical: when you read your tax treaty between Poland and any country and see formulations like “permanent home,” “center of vital interests,” “habitual abode” – you can consult the OECD Commentary and find detailed explanations of what these terms mean. And these explanations will be taken into account by Polish tax authorities and courts.

Tax Resident

The heart of every double taxation avoidance treaty is its Article 4, usually titled “Residency” or “Resident.” This article consists of several parts that together create a complete mechanism for resolving residency disputes.

Paragraph one defines who is a resident of a given state for treaty purposes. Typical wording: “For the purposes of this Convention, the term ‘resident of a Contracting State’ means any person who, under the laws of that State, is liable to tax therein by reason of his domicile, residence, place of management or any other criterion of a similar nature.”

This formulation is crucial: the treaty doesn’t create its own, autonomous definition of resident. Instead, it refers to each state’s internal law. Polish domestic law (Article 3, paragraph 1a of the PIT Act) determines who is a Polish resident. German law determines who is a German resident. The treaty accepts both these definitions as a starting point.

The problem arises when both definitions simultaneously qualify the same person as a resident. Poland says: “you’re our resident because you have your center of vital interests here.” Germany says: “you’re our resident because you stay with us longer than 183 days.” And now what? The person is a resident of two countries simultaneously? Both countries can tax them on worldwide income?

Here precisely tie-breaker clauses apply – decisive rules contained in Article 4, paragraph 2 or paragraph 3 of treaties (depending on treaty version). These rules create a hierarchy of criteria, applied sequentially until only one state can be recognized as the state of residency.

Residency Certificate

An Auxiliary Document, Not Decisive

A tax residency certificate is an official document issued by a tax office confirming that during a specified period, a given person was a tax resident of a given country. In Poland, it’s issued by the head of the tax office upon taxpayer request (Article 306l of the Tax Ordinance). The certificate is often required by foreign tax authorities, withholding tax payers, banks as proof of residency entitling use of double taxation avoidance treaty provisions.

But it’s crucial to understand what the certificate IS NOT: it’s not a constitutive document that creates residency. It’s a declaratory document that confirms existing residency.

Issuing a certificate, the office states: “based on available information, the given person was a resident during the specified period.” But if it later turns out the factual state was different (e.g., the person actually didn’t meet residency criteria), the certificate doesn’t protect against tax consequences.

Practical consequences:

First: possessing a foreign residency certificate isn’t sufficient to automatically lose Polish residency. Polish tax authorities can challenge residency change despite possessing a foreign certificate if they determine you actually still meet Polish residency criteria.

Second: lack of a Polish residency certificate doesn’t automatically mean you’re not a Polish resident. The certificate is only an auxiliary document. Residency is determined by facts, not documents.

Third: in a dispute between tax authorities, certificates from both countries can be submitted as evidence but aren’t decisive. Authorities will analyze the actual state of affairs.

When to Use Our Services

✓ International relocation – ensure you’re not paying twice

✓ Work in one country, family life in another – establish who’s entitled to the tax

✓ Temporary contract abroad – check if it changes residency

✓ You possess residency certificates from two countries – establish which matters

✓ You received tax payment demands from authorities in two countries – stop the escalation

✓ You’re planning residency change – prepare legally and safely

Resolved Cases

Case 1: Engineer Working in Germany, Family in Poland

Situation: One of the most common disputed cases. A person works in Germany Monday through Friday, lives there in a rented apartment. But on weekends returns to Poland, where wife and children live in the family home. During the year, spends approximately 200 days in Germany (work), approximately 165 days in Poland (weekends, vacations, holidays).

Problem: According to Polish domestic law: may be a Polish resident because they have their center of personal interests here (family) and center of economic interests may be debatable.

According to German domestic law: may be a German resident because they spend more than 183 days there.

Solution: Treaty analysis and application of tie-breaker clauses from the Polish-German treaty showed that:

- Permanent home in both countries (house in Poland, apartment in Germany) – DOESN’T DECIDE

- Center of vital interests is in Poland (minor children being supported, intention to return)

- Status: Polish resident, limited tax liability in Germany

- Result: Client knows they file all income in Poland, in Germany they pay only installments subject to deduction. No double taxation.

NOTE! This is a classic difficult case – family in Poland, work in Germany. Based on OECD Commentary, it’s necessary to assess where the closer ties are. If children are minors and remain dependent, family bonds usually weigh more. If the person plans to return permanently to Poland in the future, this also indicates Poland as the vital center. If instead they plan to bring family to Germany, this indicates Germany.

NOTE 2! If criterion 2 hadn’t decided, criterion 3 would need consideration: Habitual abode. Since the engineer spends more time in Germany – if this criterion were decisive, it would indicate Germany as tax residency.

Case 2: Relocation During the Year – “Split Residency”

Situation: Client left for the Emirates in February 2024 with intention of permanent residence, rented an apartment, took full-time employment, established local relationships. In Poland, only a bank account and co-ownership of an apartment remained. Spends over 300 days there. In Poland spends approximately 50 days total (family visits).

Problem: How to file the tax year in which the relocation occurred?

Solution: We confirmed so-called “split residency”:

- January-February – as Polish resident files in Poland income from this period on the basis of unlimited tax liability

- March-December – as UAE resident has limited tax liability in Poland – only on income earned in Poland

Result: Client filed correct tax return in Poland for both periods. From March doesn’t pay tax in Poland on foreign income.

Case 3: Singapore – Temporary Stay or Residency Change?

Situation: Taxpayer planned a two-year stay in Singapore with family to develop the capital group’s Asian division. Main assets (shares in Polish companies), remuneration from Polish management boards, parents and sister in Poland. Intention to return after project completion.

Problem: Does staying in Singapore more than 183 days mean losing Polish residency?

Solution: We obtained a ruling confirming the taxpayer retains Polish residency because:

- The stay has temporary, business character

- Main income sources remain Polish

- Doesn’t liquidate ties with Poland (assets, business activity, family)

- Intention to return

Result: Taxpayer legally stays in Singapore while filing taxes in Poland. No risk of challenge by either country.

NOTE! The authority specified that it assesses this “assuming circumstances described in the application don’t change.” If after a year the taxpayer changed their mind, sold Polish assets, transferred family permanently, began applying for Singapore residency certificate – the assessment could be different.

Case 4: Dental Technician – Relocation to Norway

Situation: Taxpayer with wife relocated to Norway in July 2022, began full-time employment. In August 2023 their son was born in Norway. Family stays in Norway throughout the year (over 335 days), in Poland only three weeks vacation. In Norway: rented apartment, work, two Norwegian bank accounts, car, language courses, civic activity, Norwegian residency certificate. In Poland only a plot remained (no house, no income) and one bank account for convenience during visits.

Problem: Doesn’t leaving a plot and account in Poland mean retaining Polish residency?

Solution: It was possible to confirm loss of Polish residency from July 2022 because the taxpayer actually transferred entire life:

- Work in Norway (main and only income source)

- Permanent home in Norway

- Center of personal interests in Norway (wife, child born in Norway)

- Social activity in Norway (assimilation, language courses, voting)

- Stay in Poland negligible (below 183 days, only vacation)

- In Poland exclusively passive assets without generating income

Result: Taxpayer from July 2022 files exclusively in Norway. Passive plot in Poland doesn’t create tax liability. This is an example of “textbook” residency change – authentic, comprehensive, without significant ties to country of origin.

Why Kancelaria Skarbiec?

Specialization in international tax law

We focus on complex cross-border matters. We have experience applying double taxation treaties with dozens of countries.

Hundreds of residency cases

We handle dozens of residency determination cases annually. We know international treaties, the latest rulings and case law. We know how authorities in Poland and abroad react.

Protective opinions and individual tax rulings

Our applications are detailed and based on the latest administrative court case law and authority rulings. In case of dispute, you have ready defense.

Over the past three years we’ve obtained dozens of favorable individual rulings in residency matters.

Contact

Don’t wait for authorities to challenge your tax filings. Check your tax residency and be on the safe side.

Complete the form and schedule a consultation with experienced legal counsel specializing in establishing and changing tax residency.

Form

Frequently Asked Questions About Tax Residency

- Can international treaties change what Polish law says about my residency?

Yes – and this is crucial. International double taxation avoidance treaties take precedence over Polish domestic law. Even if according to the Polish PIT Act you’re a Polish resident, a treaty with another country can definitively decide otherwise. This follows from Article 4a of the PIT Act and Article 91 of the Polish Constitution. In practice: Polish law is the starting point, but the international treaty has the final word.

- What does the residency determination process look like when I live in two countries?

Analysis proceeds in two stages:

Step 1: We check whether according to Polish law (Article 3, paragraph 1a of the PIT Act) you’re a Polish resident.

Step 2: We check whether a double taxation avoidance treaty exists between Poland and the other country and whether this treaty modifies conclusions from step one.

Only after completing both steps can we definitively establish where your tax residency is. Omitting either step leads to incorrect conclusions.

- What are tie-breaker clauses and when are they applied?

Tie-breaker clauses are a hierarchy of five decisive criteria applied when two countries simultaneously recognize you as their resident.

The hierarchy is as follows:

- Permanent home

- Center of vital interests

- Habitual abode

- Nationality

- Mutual agreement procedure (MAP)

Criteria are examined sequentially – if the first decides, subsequent ones are no longer examined. In 95% of cases, residency is established at criterion 1 or 2.

- I work in Germany but family lives in Poland. Where is my residency?

This is one of the most common disputed cases. There’s no automatic answer – a comprehensive assessment of facts decides:

- Where do you have a permanent home? (Probably in both countries)

- Where are closer personal and economic ties? (center of vital interests)

- If children are minors and dependent on you → often indicates Poland

- If you plan to return to Poland → indicates Poland

- If you plan to bring family to Germany → indicates Germany

Each case requires individual analysis considering all circumstances.

- I relocated abroad in March. Am I a Polish resident for the entire year?

No – so-called “split residency” is possible. This means:

- From January to March: you were a Polish resident (unlimited tax liability in Poland)

- From March to December: you’re a resident of the other country (limited tax liability in Poland – only on Polish income)

This requires filing an appropriate tax return showing status change during the year. The moment of residency change is determined by facts: when you actually transferred your center of life.

- I have a residency certificate from the UAE. Does this mean I’m no longer a Polish resident?

Not automatically. A residency certificate is an auxiliary document, not decisive. It’s confirmation, not constitutive proof.

Residency is determined by facts, not documents:

- Possessing a foreign certificate doesn’t guarantee loss of Polish residency if you haven’t actually transferred your center of life

- Polish authorities can challenge residency change despite a foreign certificate

- In disputes, what counts is: where you live, where you work, where family is, where assets are

- I don’t have a Polish residency certificate. Does this mean I’m not a Polish resident?

No. Lack of certificate doesn’t mean lack of residency. The certificate is only a document confirming factual state – if facts indicate you’re a Polish resident (center of life in Poland, most time in Poland, family in Poland), you are one even without a certificate.

The certificate is often required by foreign institutions (banks, employers, authorities) to prove residency, but doesn’t create it itself.

- I’m leaving for Singapore for two years for business purposes. Do I lose Polish residency?

Not always. Even a long stay abroad doesn’t have to mean residency change if:

- The stay has predetermined, temporary character

- You don’t liquidate ties with Poland (assets, business activity, family remain)

- Main income sources remain Polish

- You openly declare intention to return

We had a case of a client who stayed in Singapore for two years, but authorities confirmed retention of Polish residency due to the above circumstances. Each case requires individual analysis.

- What is an individual tax ruling and why should I apply for one?

An individual tax ruling is an official position of the tax authority confirming your residency in specific circumstances.

Benefits:

- Legal protection – no authority can challenge your position

- Legal certainty – you officially know where you’re a resident

- Proof in dispute – if another country challenges residency, you have an official document

When worthwhile? In complex cases when: you divide life between countries, have temporary contract abroad, possess certificates from two countries, are planning relocation.

All case examples described on this page are real individual rulings.

- Is determining residency a mechanical check of regulations?

No. It’s a comprehensive assessment of a person’s life:

- Where you live and how long

- Where you work and where income comes from

- Where family and friends are

- Where assets are

- Where you plan your future

- What your intentions are (temporary or permanent stay)

International law provides tools for resolution (5 tie-breaker criteria), but doesn’t replace facts. The key question: where is your life really?

- I’m considering returning to Poland in the future. Does this affect my residency now?

No. Residency is assessment of factual state at a given moment, not an irrevocable commitment for life.

We had a case of a client who left for the UAE “with intention of permanent residence” but later “was considering return.” The authority confirmed loss of Polish residency from moment of departure because at that moment the client actually transferred life to UAE.

People can change plans. If you return to Poland, you’ll become a Polish resident again from the day of return. This will be another “split residency,” but in the other direction.

- How long does tax residency determination take?

Depends on chosen path:

Legal opinion: 7-10 business days from gathering all information

Individual tax ruling:

- Application preparation: 2-3 weeks

- Authority procedure: 3 months (statutory deadline)

- Total: approximately 4 months

Urgent cases: If you’ve already received a payment demand from authorities, we can act in expedited mode with legal opinion in 3-5 days.

Have another question?

Each situation is different. If you didn’t find answer to your question, contact us