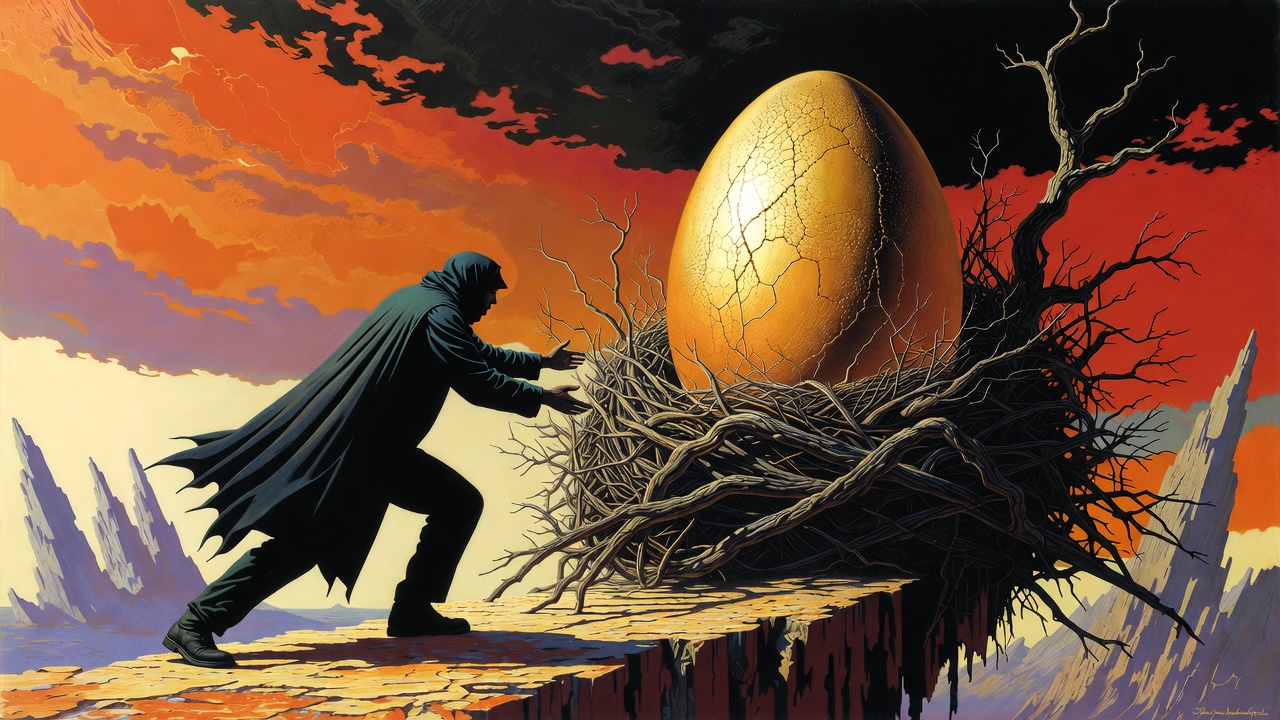

Asset Protection – Fortifying What You’ve Built

Asset protection is the foundation of responsible business. It always has been.

“Let him who desires peace prepare for war,” wrote Vegetius in the fourth century. Sixteen hundred years later, the maxim has lost none of its force. An entrepreneur who builds wealth without thinking about how to protect it is like a man constructing a castle without walls—everything he’s raised stands open to the first marauder who happens by.

The Anatomy of Threat

Running a business is, at its core, the art of managing risk—and that includes safeguarding what you’ve already accumulated. The client who doesn’t pay. The investment that fails to materialize. The market crisis that rewrites the rules overnight. The administrative decision that calls years of work into question.

Sébastien de Vauban, the brilliant military engineer who fortified the realm of Louis XIV, was known to say that a good fortress is one that repels not a single attack but every conceivable one. Asset protection works on the same principle: it must anticipate threats that haven’t yet appeared on the horizon.

The Prussian strategist Carl von Clausewitz wrote of the “fog of war”—the uncertainty that envelops every decision made under conditions of conflict. Entrepreneurs operate in a similar fog. They cannot know which customer will prove insolvent, which agency will launch an audit, which business partner will resort to litigation. What the bank will do. What the family will do.

Effective asset protection means building a position that holds even when the fog lifts to reveal the worst-case scenario.

The Law as Shield and Sword

Sun Tzu taught: “Invincibility lies in defense; the possibility of victory lies in attack.” The legal system offers defensive instruments—one simply has to know how to wield them.

A capital company separates personal assets from business assets. The family foundation—available in Poland since 2023—shields wealth from claims against its founder while enabling controlled succession. International structures add yet another defensive layer.

But a shield alone is not enough. Sometimes you have to counterattack. An opposition to enforcement allows you to challenge the very title under which execution proceeds. A complaint against a bailiff’s action corrects procedural abuses. Asset protection is not passive waiting for the blow to land—it is the active shaping of the battlefield.

The State as Adversary

Entrepreneurs must reckon not only with private creditors. Increasingly, it is the state itself that poses the threat to wealth—and it commands instruments whose effectiveness is hard to overstate.

Tax authorities can seize assets swiftly and without warning when they determine that an obligation is at risk. The law specifies the conditions for securing claims against a company’s property, but practice shows that authorities interpret these conditions broadly. A taxpayer’s assets may be seized only on justified grounds—cold comfort when the accounts are already frozen.

Extended confiscation and criminal asset forfeiture goes further still, allowing the state to reach assets acquired years before any proceeding began. And the mechanism of seizure without judgment means an entrepreneur can lose liquidity before ever appearing in court.

In recent years, the state’s arsenal has expanded systematically. The unchecked proliferation of coercive instruments means that mechanisms once introduced tend to remain—and to be applied with increasing frequency.

Time as Strategic Variable

Helmuth von Moltke the Younger, chief of staff of the Imperial German Army, held that “mistakes made in the strategic deployment phase cannot be corrected during the campaign.” In asset protection, this principle operates with full force.

Protective structures must be established before the threat materializes. A transfer of assets made in the face of execution may be challenged as fraudulent. A foundation created the day before a seizure order protects nothing. The best fortification is one built in peacetime, when no one is yet knocking at the gates.

What matters is understanding the relationship between asset seizure and asset protection: actions taken after proceedings have begun are already too late—and may be deemed not merely ineffective but criminal.

Niccolò Machiavelli warned: “A prince who relies solely on fortune falls with it.” An entrepreneur who counts on problems passing him by is playing roulette with fate. Asset protection means trading gambling for planning.

The Psychology of the Besieged

Asset protection is also psychological protection—the peace of mind that comes from knowing not everything can be taken. That there exists a line execution cannot cross. That the family will not be left without means.

Seneca wrote: “It is not the man who has too little who is poor, but the one who hankers after more.” But it’s hard to philosophize about moderation when the bailiff is seizing your account.

Layered Architecture

Vauban did not build single walls. He created fortification systems: moats, bastions, outworks that forced the attacker to mount assault after assault. Each obstacle overcome revealed the next. Effective asset protection works the same way.

The first layer: a corporate structure that separates business risk from personal wealth. The second: diversification of assets across jurisdictions. The third: legal instruments—private foundations (including offshore foundations), trusts, investment policies, offshore companies in “tax havens“—that add further levels of separation. The fourth: procedural knowledge of defensive measures available in legal proceedings.

None of these layers is impenetrable on its own. But together they form a system that dramatically raises the cost and difficulty of attack. And in the logic of conflict—as Liddell Hart taught—you win not by destroying the adversary but by making the continuation of the fight no longer worth his while.

The Ethics of Defense

There is a difference between protecting assets and hiding them from legitimate claims. The first is legal and ethically justified. The second leads to criminal liability and the destruction of reputation.

Read more about when asset protection may become a crime:

- Flight with Assets from Creditors (Art. 300 Criminal Code)

- Money Laundering (Art. 299 Criminal Code)

- Bankruptcy as a Crime (Art. 301 Criminal Code)

- Preferential Treatment of Creditors (Art. 302 Criminal Code)

Kancelaria Prawna Skarbiec

Since 2006, we have been helping entrepreneurs protect their assets—through the selection of legal structures, the creation of foundations and international vehicles, and representation in enforcement proceedings. Every situation is different: different business profile, different character of assets, different level of threat.

We do not offer magic solutions. We offer legal architecture tailored to the client’s circumstances—and the experience to build that architecture before it’s too late.

“The supreme art of war is to subdue the enemy without fighting,” Sun Tzu observed. In asset protection, this principle carries particular weight. The best execution is one that cannot begin because there is nothing to seize. Our task is to make it so.

Further Reading:

- Board Member Liability for Company Obligations

- The Murdoch Dynasty Saga | Nevada Asset Protection Trust: The Succession Trap—How the Best Legal Documentation Cannot Replace Family Harmony

- Lost in the Company: Marriages Trapped in Shared Business

Founder and Managing Partner of Skarbiec Law Firm, recognized by Dziennik Gazeta Prawna as one of the best tax advisory firms in Poland (2023, 2024). Legal advisor with 19 years of experience, serving Forbes-listed entrepreneurs and innovative start-ups. One of the most frequently quoted experts on commercial and tax law in the Polish media, regularly publishing in Rzeczpospolita, Gazeta Wyborcza, and Dziennik Gazeta Prawna. Author of the publication “AI Decoding Satoshi Nakamoto. Artificial Intelligence on the Trail of Bitcoin’s Creator” and co-author of the award-winning book “Bezpieczeństwo współczesnej firmy” (Security of a Modern Company). LinkedIn profile: 18 500 followers, 4 million views per year. Awards: 4-time winner of the European Medal, Golden Statuette of the Polish Business Leader, title of “International Tax Planning Law Firm of the Year in Poland.” He specializes in strategic legal consulting, tax planning, and crisis management for business.