Switzerland remains Europe’s third-largest wealth management center, with 3.5 trillion francs in assets under management—seventy per cent of which belongs to foreign clients. This is no accident. Despite the end of banking secrecy and the advent of full tax transparency through CRS and FATCA, Swiss banks continue to offer precisely what discerning clients seek: the stability of a financial system that has weathered centuries of upheaval, genuine professionalism in asset management, and the reassuring certainty that capital, once deposited, will remain protected.

Opening an account at a Swiss bank requires specialized knowledge. Minimum deposits range from five hundred thousand to several million francs, and the documentary requirements rival those of a tax audit. Without professional guidance, the process can stretch on for months.

Our firm will guide you through the entire process of selecting and opening a Swiss bank account:

- Profile analysis

- Bank selection

- Documentation preparation

- Tax compliance verification

- Application support

A Swiss account is a strategic tool in wealth management—one that demands professional expertise and familiarity with international regulations.

Who Can Open a Swiss Bank Account?

Formal Requirements vs. Market Reality

In theory, any adult foreigner may submit an application to open an account in Switzerland. In practice, matters prove considerably more complicated. Swiss banks employ rigorous KYC (Know Your Customer) procedures and classify clients according to risk profile.

If you happen to be a politically exposed person, a resident of a country with a low ranking on the Corruption Perceptions Index, or engaged in business within a sector deemed high-risk, prepare yourself: minimum deposits may range from five to twenty-five million Swiss francs. This is not an insurmountable barrier, but it demands proper preparation and professional counsel and legal advisory.

For clients with a standard risk profile, minimum deposits in private banking begin at five hundred thousand to one million francs. But take note—this is merely the entry point. Truly prestigious institutions such as Julius Baer or Pictet expect considerably more.

Swiss Bank Rankings: Minimum Deposits and Requirements for 2026

The Swiss private banking market resembles a pyramid, with each tier maintaining its own requirements and service standards.

At the apex stand the traditional private banking institutions. Julius Baer requires a minimum of one million francs; Pictet, eight hundred thousand to one million; Lombard Odier, similarly. These are establishments with centuries of tradition, where client service has been refined into an art form requiring years of experience. Here, one does not purchase financial products—one builds relationships that span generations.

In the middle tier reside mid-sized banks such as J. Safra Sarasin, EFG International, and Union Bancaire Privée. Minimum deposits hover between five hundred thousand and one million francs. These institutions offer an excellent equilibrium between personalized attention and breadth of product offerings.

At the base—or perhaps in the vanguard—one finds digital banks and neobanks. Alpian accepts clients from as little as two thousand francs, while Swissquote requires no minimum deposit whatsoever. Does this mean Swiss banking has become accessible to the average person? Not quite. Even these banks apply stringent verification procedures, and not everyone passes through the compliance sieve.

What Documents Are Required to Open a Swiss Account?

Opening a Swiss bank account is not a matter of completing an online form in five minutes. The process can take anywhere from a week to a month, and the required documentation resembles preparation for a tax audit.

For a personal account, you will need: a valid passport or identity card (original or notarially certified copy), proof of address no older than three months, documents confirming the source of income (employment contract, tax returns from recent years), a curriculum vitae with detailed career history, and—crucially—a declaration of the source of funds you intend to deposit.

This last requirement merits particular attention. Swiss banks wish to know not only where your money comes from but also why you wish to transfer it to Switzerland at this particular moment. Is it proceeds from a property sale? An inheritance? Dividends from a business? Every answer must be supported by documentation. Vague assertions such as “savings from employment” will not pass muster.

✓ Key Requirements:

- Valid identity document

- Proof of address (maximum 3 months old)

- Evidence of income source

- Detailed declaration of funds’ origin

⚠️ Common Mistakes: Generic statements like “savings from work” will not survive verification. Every franc must have a documented source.

For a corporate account, requirements expand further. Beyond standard company registration documents, you must provide a detailed business plan, information on all ultimate beneficial owners (UBOs), certified passport copies for all directors, documentation of the ownership structure, and—once again—proof of capital origin.

The True Cost of a Swiss Account for Non-Residents

If you imagine that a Swiss account offers only prestige and security, prepare yourself for a cold shower in the form of non-resident fees. And I am not referring to standard account maintenance charges, which in Switzerland already exceed those in most European countries.

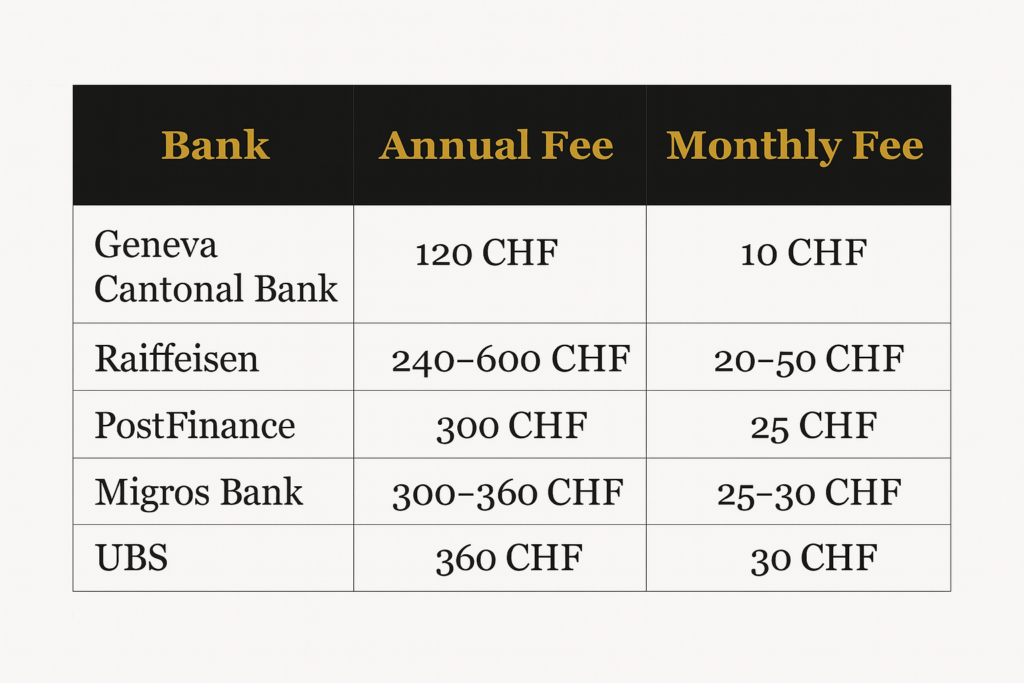

Swiss banks impose additional annual fees solely because you are not a resident. PostFinance charges three hundred francs annually (twenty-five francs monthly); UBS, an additional three hundred sixty francs; Migros Bank, three hundred to three hundred sixty francs depending on location; Raiffeisen, two hundred forty to six hundred francs depending on branch. Geneva Cantonal Bank asks the least—a mere one hundred twenty francs per year.

Commercial Banks — Additional Annual Fees

In private banking, figures are naturally higher. Pictet charges between eight hundred and over four thousand francs annually, depending on service level. Smaller private banks range from two hundred to one thousand francs per year.

Private Banks — Additional Annual Fees

How do banks justify these fees? Officially: country-specific regulations, higher administrative costs, elevated risk, compliance expenses, and intensive monitoring procedures for high-risk clients. Unofficially: because they can. Swiss banking remains a seller’s market, not a buyer’s.

Banking Secrecy in Switzerland: What Changed After CRS and FATCA?

For American clients, the situation is particularly complex. Switzerland has implemented FATCA since 2014, currently under Model 2, with a planned transition to Model 1 likely from January 1, 2027. What does this mean in practice? Swiss banks report directly to the IRS regarding all accounts belonging to persons subject to U.S. tax obligations. Non-compliance triggers a thirty per cent withholding tax—a draconian penalty that renders normal operations effectively impossible.

For residents of other countries, CRS (Common Reporting Standard) applies. Your Swiss bank will automatically exchange information about your account with tax authorities in your country of tax residence. This is not optional. This is not something that can be circumvented through “clever” structures. This is the reality of contemporary offshore banking.

Paradoxically, this transparency makes Swiss accounts more—not less—attractive to honest clients. If your finances are in order, if you file taxes properly in your country, a Swiss account presents no tax complications whatsoever. Quite the contrary: it becomes an element of legitimate diversification and risk management.

In Brief:

✗ Swiss banking secrecy is suspended for tax reporting purposes (since 2017) ✓ Automatic information exchange with the EU and 100+ countries ✓ Full transparency = security for honest clients ✓ A legitimate means of wealth diversification

For Whom Does a Swiss Bank Account Make Sense?

A Swiss account makes sense for:

- Individuals with assets exceeding €500,000 who require stability and professional asset management within one of the world’s most secure banking systems.

- Entrepreneurs with international business operations who need efficient multi-currency transfers and access to global financial markets.

- Families planning wealth succession who wish to secure capital for future generations within a stable legal and tax environment.

A Swiss account does NOT make sense for:

- ❌ Those seeking to “hide” assets from tax authorities

- ❌ Clients with amounts below €200,000–300,000

- ❌ Those unable to document the source of their capital

A 2025 study from the University of St. Gallen demonstrates clearly that two business models thrive in the Swiss private banking market: large international banks with broad service offerings (average ROE of 11.4%) and small niche banks focused on highly specialized service (average ROE of 9.6%). Mid-sized banks attempting to be everything to everyone achieve a mere 4.4% ROE. What does this mean for clients? That it pays to choose either established brands with global reach or highly specialized financial boutiques—the middle path is rarely optimal.

The Future of Swiss Banking

The Swiss private banking market is undergoing profound transformation. The number of private banks is declining—from eighty-five at the start of 2024 to fewer than eighty by the end of 2025. Major consolidation transactions continue, such as UBP’s acquisition of Société Générale Private Banking (10.1 billion francs in assets) and J. Safra Sarasin’s purchase of a 69.71% stake in Saxo Bank.

The principal challenges? Declining interest income following the end of the high-interest-rate period, mounting pressure on margins and profitability, and the fact that only thirty-one per cent of banks achieve returns on equity exceeding their cost of capital. This is not encouraging news for the industry, though not necessarily unfavorable for clients—in conditions of heightened competition, banks must compete for clients through service quality, not merely brand prestige.

Simultaneously, new opportunities emerge: the development of digital banking and hybrid services, the application of artificial intelligence in wealth management, and new products such as L-QIF (Limited Qualified Investor Funds). Swiss banking is not dying—it is evolving, adapting to the realities of the twenty-first century.

Our Services

The process of opening a Swiss bank account is complex and requires specialized knowledge and experience. Our firm offers comprehensive support at every stage.

Complete Service in Five Steps

Step 1: Profile Analysis and Bank Recommendation

We assess your risk profile and select an institution ideally suited to your needs and capabilities.

Step 2: Documentation Preparation

We compile all required documents in accordance with current Swiss regulatory requirements.

Step 3: Tax Compliance Verification

- We verify compliance with Polish and international tax regulations (CRS, FATCA).

Step 4: Application and Representation

We guide you through the application process and represent you in communications with the bank.

Step 5: FATCA/CRS Reporting Advisory and Tax Optimization

We assist with proper reporting and legitimate tax burden optimization and tax planning.

Remember: a Swiss account is not an end in itself but a tool within a broader wealth management strategy. The decision to open one should be preceded by analysis of your tax situation, financial objectives, and expectations of a banking institution.

Contact

Discover the possibilities of modern Swiss banking—schedule a consultation. We will guide you through the entire process.