What is Private Banking and who is it for?

Managing wealth that exceeds several hundred thousand euros is an entirely different discipline from maintaining an ordinary personal account.

This isn’t about safely storing funds and executing wire transfers.

You need:

- comprehensive tax planning,

- investment strategy calibrated to your risk profile,

- succession planning,

- corporate structures that protect your assets.

Standard retail banking—even in its “premium” incarnation—simply doesn’t offer this.

Here begins the world of private banking. It is not a product one purchases by completing an online form. It is a long-term relationship with an institution that will come to know your financial circumstances more intimately than you do yourself, anticipate threats you haven’t yet imagined, and open doors to opportunities whose existence you never suspected.

Is Private Banking for you?

Quick check:

✓ Assets exceeding €500,000

✓ Need for professional tax planning

✓ Considering business or family succession

✓ Seeking international diversification

✓ Looking for access to alternative investments

If you checked 3 or more—private banking may be your solution.

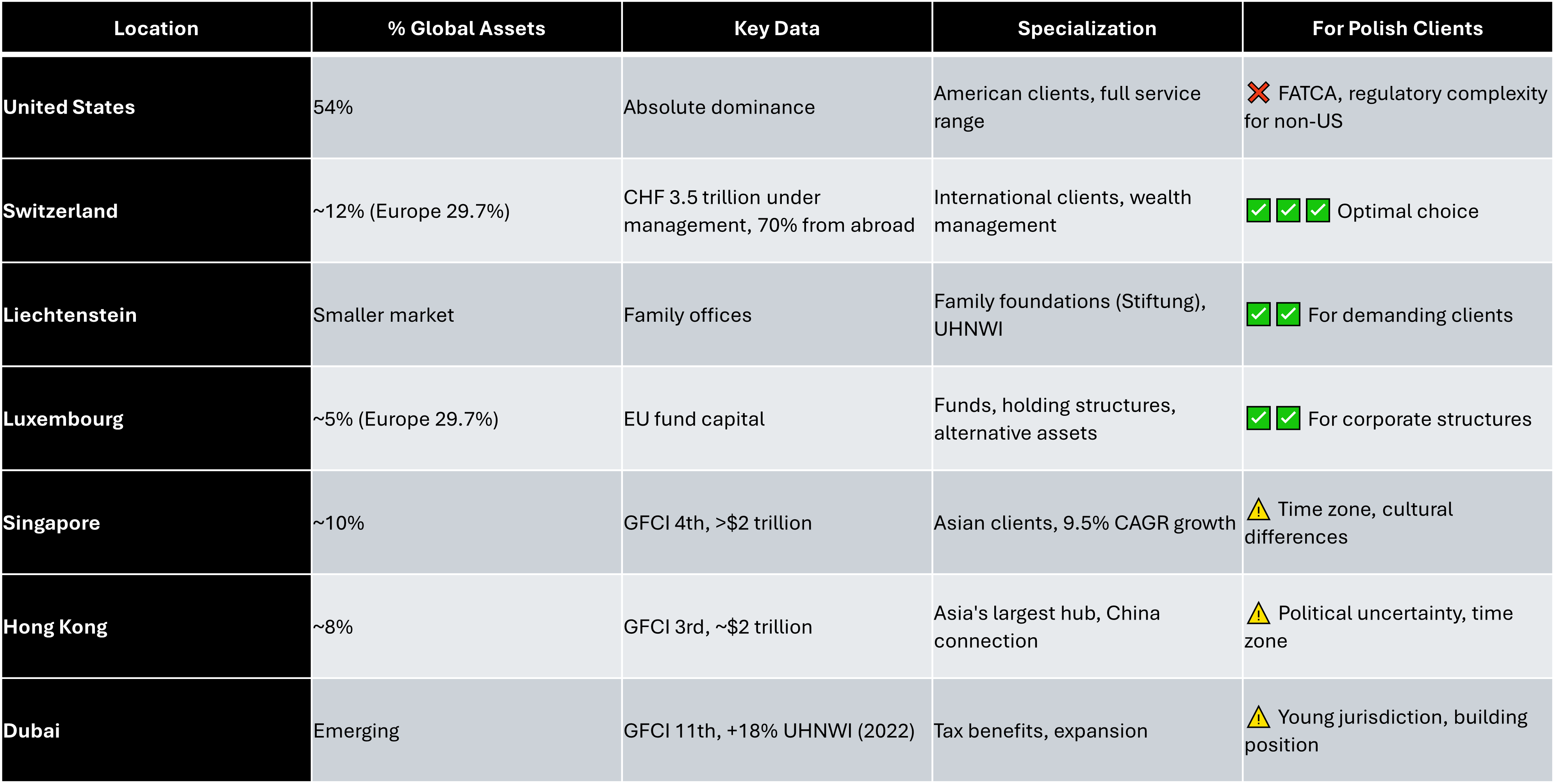

Where to open a private banking account?

The Geography of Private Money

The global private banking market today manages a staggering $162 trillion in assets, with the industry itself valued at over half a trillion dollars. This is no niche sector—it is a formidable financial apparatus serving the world’s wealthiest individuals. But not all markets are created equal.

The United States dominates without question, holding 54% of global assets under management. Yet is an American private bank the right choice for a European client? Not necessarily. FATCA requirements, regulatory complexity for non-U.S. clients, and—above all—cultural differences in wealth management philosophy make it a suboptimal solution for most Polish clients.

Europe manages 29.7% of global assets, its core formed by an unshakeable triad: Switzerland, Liechtenstein, and Luxembourg. Here beats the heart of European private banking. The reasons are compelling.

Switzerland and Swiss bank accounts remains the undisputed leader—managing 3.5 trillion Swiss francs, making it Europe’s third-largest asset management center. Zurich ranks 14th in the Global Financial Centres Index, Geneva not far behind. More significantly, 70% of deposits originate from foreign clients. Swiss banks understand how to serve international clientele; they grasp the specifics of cross-border tax structures and possess deep experience with complex corporate arrangements.

Liechtenstein represents a smaller market, but no less sophisticated. The principality specializes in family offices and family foundation structures (Stiftung), offering solutions for the most demanding clients. Here, minimum deposits begin where they end elsewhere.

Luxembourg serves as Europe’s capital for investment funds and holding structures. If your wealth management strategy requires engagement with alternative assets, private equity, or complex structured instruments, Luxembourg is the natural choice.

Singapore and Hong Kong constitute Asia’s private banking centers, collectively managing over $4 trillion. Singapore holds 4th place in the GFCI, Hong Kong 3rd. These are the fastest-growing markets (9.5% CAGR), though for European clients they introduce additional complexity—time zone differences, cultural distinctions in business approach, and the necessity of understanding local regulations.

Dubai emerges as a rising player, ranked 11th in the GFCI, recording an 18% increase in ultra-high-net-worth individuals in 2022. The tax advantages are undeniably attractive, but is it wise to build a long-term wealth management strategy in a jurisdiction still establishing its position on the global financial map? That’s a question each client must answer.