How to Protect Yourself From Unfair Contracts: A Consumer’s Guide

The Fine Print: What to Know Before You Sign – and What to Do When You Already Have

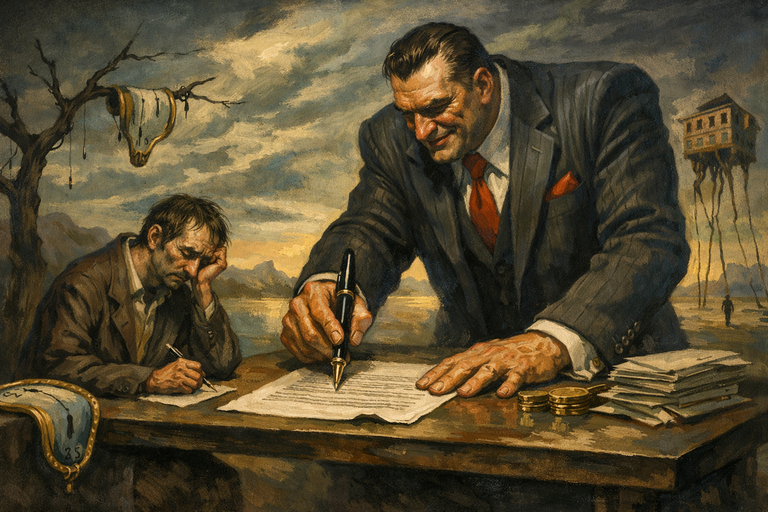

You’re sitting across from a bank officer, or scrolling through a telecom provider’s endless terms and conditions, or standing in the fluorescent gloom of a storefront lender’s office. A contract awaits your signature. The other side has lawyers—lots of them—and you have approximately ninety seconds to decide. How do you protect yourself from an unfair deal when the deck is so obviously stacked?

Here’s the good news, such as it is: you’re not entirely alone. European Union law and Poland’s Constitution impose on courts an affirmative duty to protect consumers—even those who don’t realize they’ve been wronged. The system, in theory, is designed to catch you when the fine print trips you up.

Before You Sign: A Spotter’s Guide to Contract Red Flags

The first line of defense is awareness. Before your pen touches paper, watch for these warning signs:

Interest rates and hidden fees. If the quoted rate seems implausibly high, or if it’s buried in a thicket of small type, proceed with caution. In one case that eventually reached Poland’s Supreme Court, a consumer spent nineteen years paying off a loan that carried interest of nine per cent per day—an annualized rate exceeding three thousand per cent. (The monthly statements must have made for grim reading.)

Jurisdiction clauses. Does the contract require that any disputes be resolved in a court located hundreds of miles from your home? This is a classic abusive clause—one that the European Court of Justice dismantled in its landmark Océano ruling, back in 2000.

Penalty provisions. Disproportionately steep penalties for early termination or minor breaches often fail to pass legal muster. If the exit fee rivals the value of the contract itself, something is amiss.

Auto-renewal terms. Clauses that lock you into another contract period without your explicit consent raise serious legal questions. Companies love these; courts tend not to.

When in doubt, consult a lawyer before signing. The cost of an hour’s advice is vanishingly small compared to the cost of years spent in litigation ((ake advantage of the assistance offered by professional legal advice).

Abusive Clauses: What They Are and How to Spot Them

An “abusive clause”—known in legal parlance as an unfair contract term—is a provision that meets three criteria: it was not individually negotiated; it shapes the consumer’s rights and obligations in a manner contrary to good faith; and it grossly prejudices the consumer’s interests.

This definition originates in EU Directive 93/13/EEC and has been codified in Polish law under Article 385¹ of the Civil Code. In practice, it covers a wide range of contractual mischief:

- Provisions requiring disputes to be heard in courts convenient only to the business

- Clauses granting the company unilateral power to modify the agreement’s terms

- Language excluding liability for failure to perform—or for performing badly

- Fees and interest rates grotesquely out of proportion to the value provided

Poland’s Office of Competition and Consumer Protection maintains a public registry of terms that have been deemed abusive—a resource worth consulting before you do business with any company.

Already Signed? Your Rights as a Consumer

Signing a contract that contains unfair terms does not condemn you to live with them forever. The law provides several avenues of recourse:

Abusive clauses are not binding. Under Article 385¹ § 1 of the Civil Code, a term found to be unfair has no legal effect against the consumer—as though it had never appeared in the contract at all. The remainder of the agreement, in most cases, remains in force.

You can challenge unfair terms in court. If a business sues you based on an abusive clause, you have every right to raise unfairness as a defense.

Courts must examine clauses on their own initiative. This is the crucial part, confirmed by the European Court of Justice and recently reaffirmed by Poland’s Supreme Court: even if you fail to raise the issue yourself, the court is obligated to scrutinize the contract for unfair terms—provided, of course, that it has access to the document.

You Don’t Have to Fight Alone: The Court’s Duty

Many consumers are unaware that protection against unfair clauses does not depend solely on their own vigilance. The European model of consumer protection recognizes that consumers are, structurally speaking, the weaker party. They need institutional backup.

That’s why the European Court of Justice, beginning with its Océano decision in 2000, has consistently held that national courts must review contracts for abusive terms ex officio—on their own motion. In the 2009 Pannon GSM ruling, the Court went further: this is not merely a power that courts may exercise at their discretion. It is a procedural obligation.

Poland’s Supreme Court affirmed this principle in December of 2025, vacating a payment order that had stood for nearly two decades—one issued without any examination of the loan’s extortionate interest rate. For a detailed analysis of that watershed decision, see: Unfair Contract Terms: The Court’s Duty to Review Ex Officio | EU Consumer Law Analysis

When to Call a Lawyer

Self-help has its limits. Professional legal assistance is worth seeking when:

- You’re contemplating a high-value contract—a mortgage, a lease, an investment

- You’ve received a payment order or lawsuit based on terms you never negotiated

- A company refuses to acknowledge the unfairness of a clause, despite its obviousness

- Your case requires court action or a formal complaint to regulatory authorities

Kancelaria Prawna Skarbiec offers comprehensive support: contract analysis and negotiation, representation in consumer disputes, and the pursuit of claims arising from unfair commercial practices.

- Further reading: Antitrust / Competition Law in Poland

Questions about a contract? Contact us: ☎ +48 22 586 40 00

Robert Nogacki is a legal counsel (radca prawny) at Kancelaria Prawna Skarbiec, a Warsaw-based law firm specializing in tax advisory, corporate structures, and consumer protection.

Founder and Managing Partner of Skarbiec Law Firm, recognized by Dziennik Gazeta Prawna as one of the best tax advisory firms in Poland (2023, 2024). Legal advisor with 19 years of experience, serving Forbes-listed entrepreneurs and innovative start-ups. One of the most frequently quoted experts on commercial and tax law in the Polish media, regularly publishing in Rzeczpospolita, Gazeta Wyborcza, and Dziennik Gazeta Prawna. Author of the publication “AI Decoding Satoshi Nakamoto. Artificial Intelligence on the Trail of Bitcoin’s Creator” and co-author of the award-winning book “Bezpieczeństwo współczesnej firmy” (Security of a Modern Company). LinkedIn profile: 18 500 followers, 4 million views per year. Awards: 4-time winner of the European Medal, Golden Statuette of the Polish Business Leader, title of “International Tax Planning Law Firm of the Year in Poland.” He specializes in strategic legal consulting, tax planning, and crisis management for business.